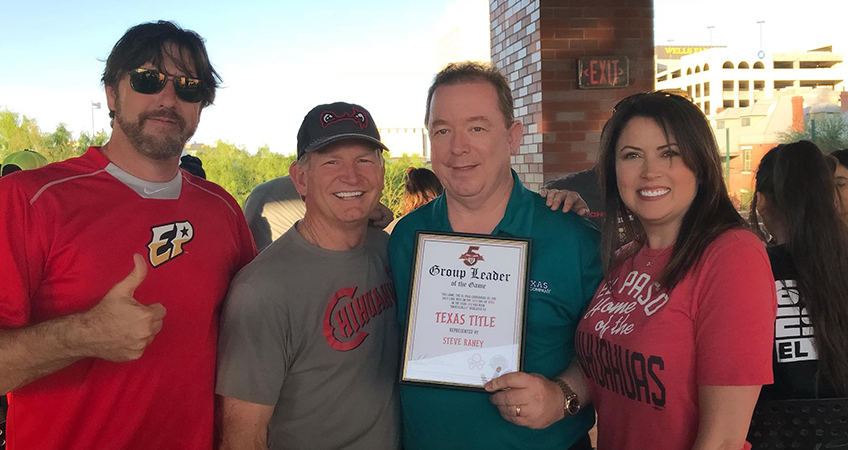

Out & About | Chihuahua Baseball & Texas Title Company

April 28, 2018

DJ’s Motivational Mondays | Focus

May 7, 2018I was recently asked to address a group about the future of our industry and the issues that will impact the independent title agent. Our industry is coming off record revenues in 2017 and a robust economy. While that is encouraging and optimistic, there are underlying problems to face. I believe the primary concern of the independent agent and independent underwriter is the consolidation of the industry. The announcement that Fidelity National Title intends to acquire Stewart Title Guaranty should have set off warning sirens in your offices. Your options of who you choose to underwrite your next file are now limited. “Families” of companies often have similar underwriting guidelines and standards, so your ability to find the solution to your underwriting problem is diminished. National underwriter market shares continue to grow, leaving fewer premiums for the independent entrepreneurs in our industry. I have said this in the past, but it bears repeating – “the independent agents and underwriters are being marginalized by the Big Four/Three.”

Are you ready to throw in the towel? No way! Nope, not me! This consolidation also creates opportunity for those agents willing to outwork those corporate behemoths. While the independent agents may be your competitors in many markets, they are also your allies. Do you want to continue to fight for the remaining 15 percent of the national title market share pool that is not controlled by the nationals? Or do you want to pursue the 85 percent the big boys think they are entitled to. Your decision is how to move forward and capture a portion of that 85 percent. Our team is prepared to help you find the solutions you need to compete.

The large underwriters no longer control high liability transactions. They no longer control plant production, and they no longer control the closing software. First National Title has the ability to underwrite transactions in excess of $200 million. We recently wrote a $65 million transaction on property in Austin. We have access to the Lloyds of London reinsurance market (just like the big boys). FNTI has a title production facility capable of providing you title evidence in 33 Texas Counties, most of Florida, and will soon be offering services in Arizona. And by integrating with various closing software programs, we have the same connectivity as any underwriter. We will continue to find the tools and resources you need to compete against the Big Four/Three.

Contact me or your agency representative to discuss our expanded services. I appreciate the opportunity to help you expand your business and share in your success.